Understanding the Credit Score Ranges

Your credit score is a vital component of your financial well-being, impacting everything from loan approvals to the interest rates you receive.

But what exactly is a credit score, and why should you care?

This article distills the essentials, covering the factors that influence your score, the importance of different score ranges, and actionable tips to enhance your credit profile. This article will also clear up common misconceptions that might be slowing you down.

Read on to take charge of your financial future!

Contents

Key Takeaways:

- A credit score indicates your credit trustworthiness.

- Payment history and credit usage are key factors.

- Understanding credit score ranges helps you manage your credit better.

What is a Credit Score?

A credit score serves as a numerical reflection of your credit reliability, calculated from various factors found in your credit report. This score is essential for lenders when making informed decisions about your credit applications.

The most prevalent credit scores you ll encounter are the FICO score, developed by Fair Isaac Corporation, and VantageScore. Both of these systems meticulously assess your financial behavior to gauge your risk level regarding loan approvals and interest rates.

Understanding this can enable you to take control of your financial future.

Definition and Importance

A credit score is more than just a number; it s a crucial indicator of your financial responsibility and credit history, playing a significant role in your ability to secure loans and credit on favorable terms.

This numerical representation is not only your key to unlocking financial opportunities but also serves as a vital tool for lenders assessing potential risk. A higher credit score often means easier access to loans, while a lower score could lead to denials or higher interest rates.

Factors like payment history which makes up a substantial part of your score highlight the importance of making timely repayments. Meanwhile, amounts owed reflect how much of your credit limits you re utilizing, which means how much credit you re using compared to your limits. Together, these elements create a comprehensive picture of your overall financial health, influencing not just loan approvals but also the terms available to you, ultimately shaping your financial future.

Factors that Affect Credit Scores

Several key factors influence your credit score, including your payment history, amounts owed, credit utilization, and the variety of credit types you hold. Each of these elements plays a crucial role in assessing your credit reliability and shaping your risk profile in the eyes of lenders.

Payment History, Credit Utilization, and More

Payment history and credit utilization stand as two of the most pivotal factors influencing your credit score, comprising a significant portion of the overall figure and reflecting your reliability in managing credit accounts.

Maintaining a positive payment history is essential; timely payments not only showcase your financial stability but also significantly boost your creditworthiness. Likewise, adept management of credit utilization ideally keeping it below 30% illustrates responsible credit usage and can lead to a favorable impact on your credit scores.

Other crucial elements include recent credit inquiries and the variety of credit types you hold, such as credit cards, student loans, and mortgages. Each of these factors plays a cumulative role in shaping your credit profile. Frequent inquiries may signal risk, while a diverse mix of credit types demonstrates your ability to manage various financial responsibilities, ultimately contributing to a healthier credit score.

Understanding Credit Score Ranges

Understanding credit score ranges is crucial for you as a borrower seeking loans. Knowing what a good credit score range is can help you navigate these classifications, which include exceptional, very good, good, fair, and poor credit.

Each classification plays a significant role in influencing lending decisions and the interest rates you may encounter.

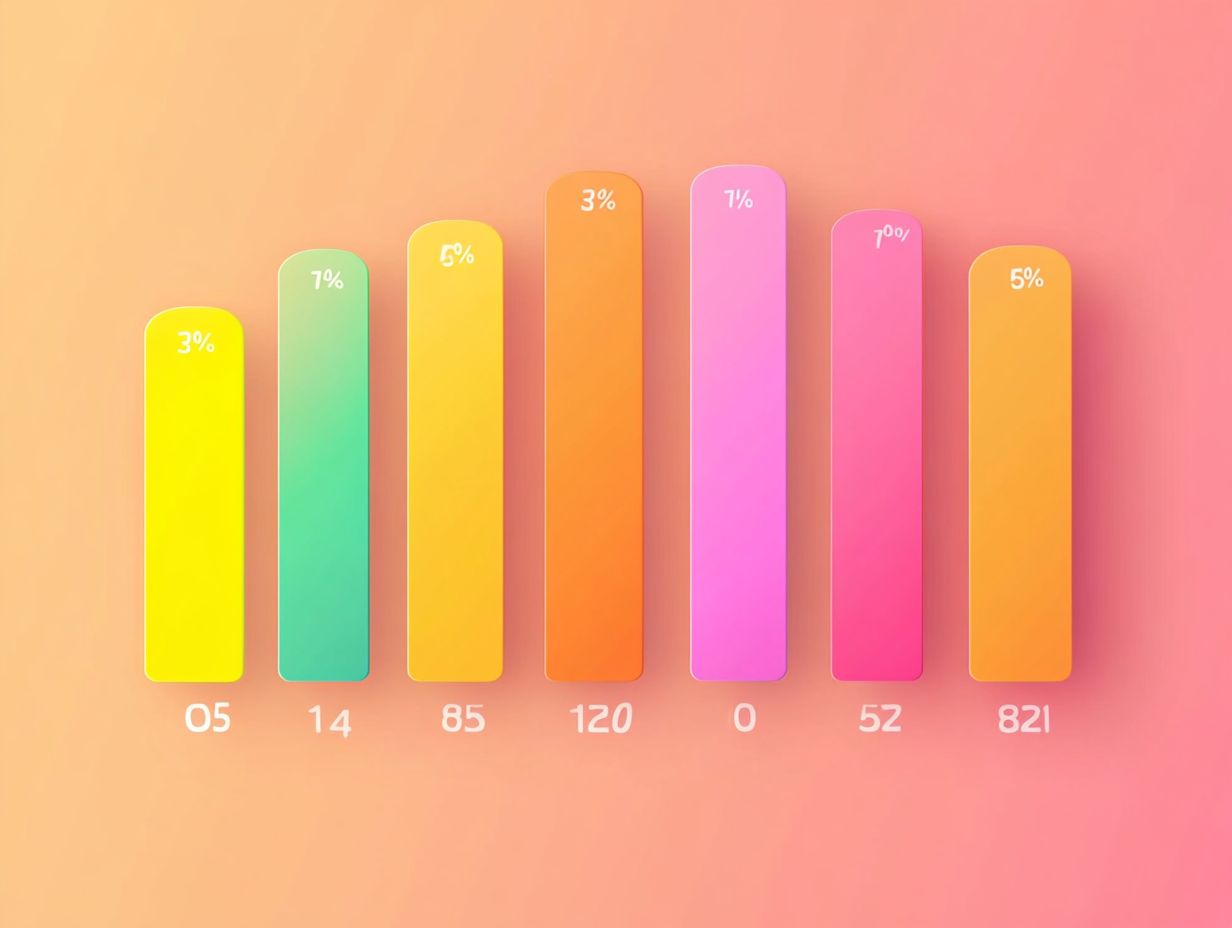

Ranges and Their Significance

Credit score ranges are vital, as they directly affect the interest rates and terms available to you as a borrower. This shapes your overall financial obligations and how lenders perceive your risk.

For example, if your credit score is excellent typically above 750 you often enjoy lower interest rates on loans. This can translate into substantial savings over time.

Conversely, if your score falls within the fair or poor range, you may face higher rates and stricter terms, significantly increasing your total repayment amount.

Picture this: a borrower with a credit score of 720 could secure a mortgage at a competitive 3.5% interest rate, while someone with a score of 580 could find themselves facing rates over 6%. This difference results in a larger monthly payment and a steeper total cost over the loan s lifespan.

These disparities underscore the profound impact credit scores have on your financial outcomes, illustrating a clear distinction in the lending landscape.

How to Improve Your Credit Score

Enhancing your credit score is entirely within your reach by employing a blend of effective credit repair strategies, vigilant credit monitoring, and upholding a commendable payment history.

It’s essential to manage your credit utilization and debt levels with care, ensuring a balanced approach that promotes sustainable improvement.

Tips and Strategies

Effective strategies for enhancing your credit score include regularly reviewing your credit report for inaccuracies and maintaining a history of timely payments. Using a secured credit card, which is a type of credit card backed by a cash deposit, can also help build a responsible credit profile.

By staying attentive to your credit report, you can spot errors that might adversely impact your score. This enables you to initiate timely disputes and corrections. Timely payments are the cornerstone of effective credit management! Set reminders to ensure you never miss one.

Employing a secured credit card showcases responsible usage and aids in building a robust credit history over time. Credit utilization, which refers to the amount of credit used compared to available credit, should ideally be kept below 30% to substantially elevate your score. Diversifying your credit types can help demonstrate financial versatility and enhance your overall creditworthiness.

Common Misconceptions about Credit Scores

Common misconceptions about credit scores can lead you to make poor financial decisions. Many borrowers often misunderstand how credit monitoring functions, the effects of credit applications, and the actual factors that influence their credit scores.

Debunking Myths and Clarifying Facts

Debunking myths about credit scores is essential for promoting an accurate understanding. Many people mistakenly believe that checking their score will lower it or that closing old credit accounts will always boost their scores.

In reality, regularly monitoring your credit helps you identify potential errors or areas for improvement. It’s crucial to understand that credit scores are influenced by various factors, including payment history, credit utilization, and the length of your credit history. Credit monitoring services play a pivotal role in keeping you informed about your credit status and alerting you to any significant changes.

By staying on top of your credit obligations like making timely payments and keeping balances low you can build a healthy credit profile that truly reflects your financial responsibility.

Frequently Asked Questions

What is a credit score range and why is it important?

A credit score range is a numerical scale reflecting how likely you are to repay borrowed money. Understanding this range is vital as it affects your chances of getting loans, credit cards, and other financial opportunities.

What are the different credit score ranges?

The most common credit score range is 300-850. A higher score means better credit, with ranges categorized as follows:

– 300-579: Very Poor

– 580-669: Fair

– 670-739: Good

– 740-799: Very Good

– 800-850: Exceptional

How are credit scores calculated?

Credit scores are based on your credit history, payment history, credit use, length of credit, and types of credit. Each factor can positively or negatively impact your score.

What is a good credit score?

A score of 670 or higher is generally seen as good. This indicates that you manage your finances well and are a low-risk borrower, improving your chances for loans with better terms.

How can understanding credit score ranges help?

Knowing where your credit stands allows you to pinpoint areas for improvement. This knowledge empowers you to make smart financial choices, like paying bills on time and reducing debt.

Are there different credit score ranges for various types of scores?

Yes, different credit scoring models like FICO and VantageScore have unique ranges. Understanding which model is used helps you interpret your score accurately.