Top Rewards Cards for Dining Out in 2024

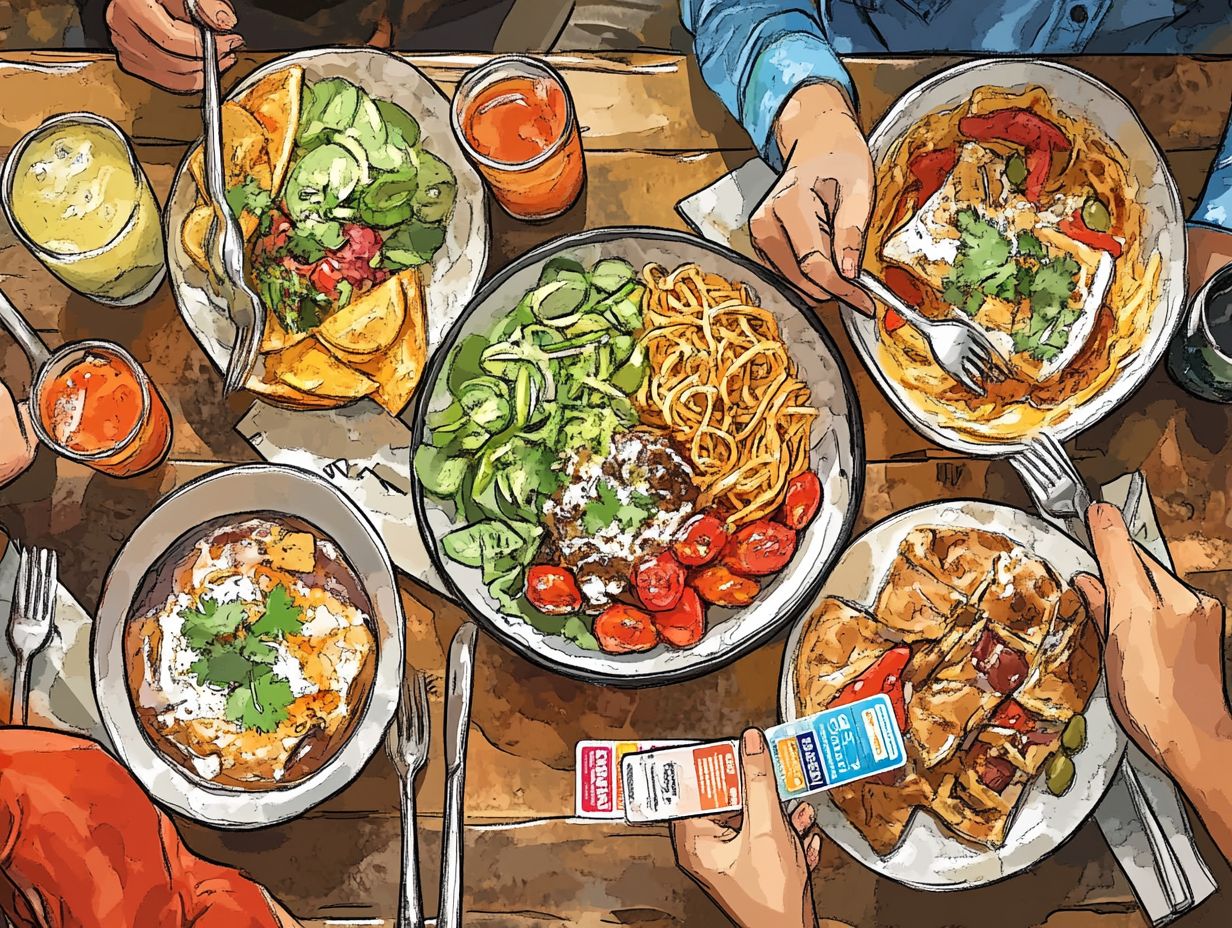

Dining out transcends the mere act of enjoying a meal; it s an experience that can be significantly elevated with the right rewards card in your wallet. Imagine savoring delicious meals while earning rewards!

In 2024, an impressive array of credit cards awaits you, each offering enticing benefits specifically designed for food enthusiasts. From generous cash back on dining purchases to exclusive perks at your favorite eateries, the options are plentiful.

This article will guide you through the top rewards cards tailored for dining, highlighting their unique features, benefits, and potential drawbacks.

Whether you re a frequent diner savoring the food scene or an occasional restaurant-goer indulging in a well-deserved treat, you ll uncover how to maximize your dining expenses and select the perfect card that complements your lifestyle.

Contents

- Key Takeaways:

- 1. Chase Sapphire Preferred

- 2. Capital One Savor Rewards

- 3. American Express Gold Card

- 4. Citi Prestige

- 5. Discover it Cash Back

- 6. Bank of America Cash Rewards

- 7. Hilton Honors American Express Surpass

- 8. Wells Fargo Propel American Express

- 9. Chase Freedom Unlimited

- 10. Uber Visa Card

- 11. Marriott Bonvoy Bold

- 12. Capital One Venture Rewards

- 13. American Express Blue Cash Preferred

- 14. Citi Double Cash

- 15. Delta SkyMiles Gold American Express

- What Are the Benefits of Using a Rewards Card for Dining Out?

- Frequently Asked Questions

- What are the top rewards cards for dining out in 2024?

- What makes the Chase Sapphire Preferred a top rewards card for dining out?

- Why is the American Express Gold Card a popular choice for dining out?

- What sets the Capital One Savor apart as a top rewards card for dining out?

- Which unique benefits does the Citi Prestige offer for dining out?

- Why is the Wells Fargo Propel a top rewards card for dining out in 2024?

Key Takeaways:

1. Chase Sapphire Preferred

The Chase Sapphire Preferred card stands out as a premier choice for individuals seeking versatile dining rewards and cash back. This card gives you the power to maximize your benefits through strategic dining purchases.

With its robust rewards structure, you ll earn 2x points on dining at restaurants and 2x points on grocery store purchases, making it an appealing option for food lovers and families alike. Every meal you savor out or grocery trip you make effortlessly translates into valuable points. Plus, the card often features enticing bonuses for new sign-ups, significantly enhancing the value you receive relative to its annual fee.

For those who frequently enjoy dining out or cooking at home, this card becomes a smart choice that perfectly aligns with your spending habits, offering a lucrative blend of convenience, rewards, and long-term value.

2. Capital One Savor Rewards

The Capital One Savor Rewards card truly shines with its outstanding cash back offerings on dining, food delivery, and entertainment, making it a premier choice for those who relish culinary adventures and dining experiences.

You ll find a generous cash back percentage specifically designed for dining and restaurant purchases, perfectly tailored to enhance your diverse culinary escapades from laid-back brunches to exquisite gourmet dinners. As a cardholder, you ll reap maximized rewards not only at your favorite dining spots but also when indulging in delivery services for those cozy evenings at home.

Whether you re grabbing a quick bite from a food truck or celebrating a milestone at an upscale restaurant, the Savor card s flexibility aligns seamlessly with your varied eating habits, ensuring that every meal becomes a rewarding opportunity.

3. American Express Gold Card

The American Express Gold Card is crafted for food enthusiasts and travelers, offering enticing dining rewards and points that elevate both your everyday grocery shopping and extraordinary culinary experiences.

With an impressive rewards structure, you can earn 4 points for every dollar spent at restaurants. This applies whether you’re dining out or enjoying takeout at home.

In terms of grocery shopping, you’ll earn 3 points per dollar spent at supermarkets, presenting a fantastic opportunity to rack up points on those essential purchases.

To truly maximize these dining benefits, it’s wise to wield the card strategically during promotions and at partner establishments. Using this approach turns your daily spending into exciting rewards, ultimately paving the way for unforgettable travel adventures.

4. Citi Prestige

The Citi Prestige card stands as a top choice, merging travel rewards with exceptional dining perks. It’s perfect for those seeking a truly enriching rewards experience through dining and travel expenditures.

With its hefty annual fee, you might find yourself questioning whether this card is worth it. However, by strategically leveraging your travel-related expenses and dining habits, you can unlock a wide range of benefits that easily justify the cost.

If you frequently enjoy dining out or traveling, you can earn substantial rewards points and gain exclusive access to premier restaurants and luxurious travel experiences. This makes a compelling case for selecting this card.

As consumer preferences shift toward valuing experiences over material possessions, the array of rewards offered by the Citi Prestige card resonates with individuals seeking a more fulfilling lifestyle.

5. Discover it Cash Back

The Discover it Cash Back card features a compelling cash back structure that thrives on special spending categories, especially for dining expenses. This card is an excellent choice for those who are mindful of their budget.

With 5% cash back on rotating categories each quarter, including dining, the rewards program remains fresh and engaging. Track your spending habits to strategically plan your dining outings and maximize those higher rewards. For example, during a quarter that emphasizes restaurants, a few extra visits can significantly boost your cash back earnings.

This feature rewards your budgeting efforts and encourages you to enjoy more dining experiences, transforming everyday expenses into valuable savings.

6. Bank of America Cash Rewards

The Bank of America Cash Rewards card offers a customizable cash back experience. You can select bonus categories tailored to your spending habits, including enticing dining rewards.

This flexibility allows you to maximize your rewards based on your personal expenditures. It gives you the power to align your choices with your lifestyle, enhancing your financial well-being. If you often dine out or love discovering new restaurants, the dining category can significantly elevate your cash back returns.

You can earn cash back that often exceeds the card s annual fee, providing exceptional value and making it easy to justify the cost while enjoying rewards every time you swipe.

7. Hilton Honors American Express Surpass

The Hilton Honors American Express Surpass card offers a remarkable fusion of travel rewards and dining benefits, tailored for frequent travelers who appreciate earning points through culinary adventures.

Every dollar you spend on dining allows you to accumulate points quickly, turning everyday meals into gateways to your next trip. This synergy between dining expenses and travel rewards amplifies the card s overall value, helping you enjoy great meals while progressing toward your next escape.

While the card does carry an annual fee, the perks like complimentary Hilton Honors Gold status and the potential for free nights greatly outweigh this cost. It s a savvy choice for those who frequently dine out and aspire to travel more.

8. Wells Fargo Propel American Express

The Wells Fargo Propel American Express card stands out as an outstanding choice for those seeking a blend of exceptional dining perks and robust travel rewards. Every purchase enhances your overall earnings.

This card combines the best of both worlds, allowing you to accumulate points while enjoying meals out, traveling, and making everyday purchases. With its distinctive points structure, you can maximize your rewards by aligning your spending habits, whether you re dining out often or booking travel through preferred channels.

For those who relish culinary experiences or seek to explore new destinations, this card complements your lifestyle. It’s a smart choice for anyone eager to optimize their rewards while indulging in flavors and adventures.

9. Chase Freedom Unlimited

Chase Freedom Unlimited offers a money back program that is refreshingly simple, especially for dining rewards. This makes it a top choice for those who value straightforward benefits without sacrificing value.

With this card, you earn an impressive percentage back on every dollar spent at restaurants, whether indulging in fine dining or grabbing a quick meal. This generous structure lets you enhance your dining experiences while maximizing rewards effortlessly.

Plus, there s no annual fee, allowing you to enjoy the benefits without extra costs. Together, these features create a rewarding experience that resonates with frequent diners, proving that managing your finances can be enjoyable.

10. Uber Visa Card

The Uber Visa Card is designed for the modern consumer, especially those who love dining out. It offers substantial money back rewards on your dining experiences and food deliveries through Uber Eats.

This card stands out due to its seamless integration with the Uber Eats platform. As a cardholder, you earn rewards with every meal you order and access exclusive promotions that enhance your dining adventures.

Whether enjoying a night out or a cozy night in, this card helps you maximize benefits from your culinary choices.

The combination of money back rewards and convenience for food delivery makes it a go-to choice for anyone who appreciates both fine dining and casual meals.

11. Marriott Bonvoy Bold

The Marriott Bonvoy Bold card is a top pick for travelers eager to earn points on dining while enjoying exciting travel rewards for hotel stays.

Using this card at eligible restaurants helps you accumulate points that contribute to free nights, room upgrades, and other perks within the Marriott ecosystem. Dining out becomes not just fun but a smart way to invest in future adventures.

Exploring local dining options enhances your travel experience, turning everyday meals into exciting opportunities for discovery. As your preferences shift toward experiences, earning points through dining aligns with your modern travel lifestyle.

12. Capital One Venture Rewards

The Capital One Venture Rewards card blends travel rewards with enticing dining benefits, allowing you to earn great points on your dining and travel purchases.

This fusion elevates your dining experiences, turning ordinary meals into golden opportunities for your next adventure. Dining out allows you to accumulate points quickly, making it easier to book that dream getaway.

These points are versatile and can be redeemed for various travel expenses, including flights, hotel stays, and rental cars. This card transforms every dining occasion into a stepping stone for future explorations, bringing your travel dreams within reach.

13. American Express Blue Cash Preferred

The American Express Blue Cash Preferred card is for those who want to maximize money back on grocery purchases and dining rewards. It transforms everyday spending into a rewarding experience.

With its great cash back setup, this card turns routine shopping and dining outings into valuable opportunities for savings. You earn a significant percentage back on groceries, boosting your budget, while dining out yields impressive returns.

Don t miss out on the chance to maximize your savings with this card! It benefits households that prioritize grocery shopping, allowing cash back to accumulate quickly.

Over time, the rewards can lead to substantial savings that enhance your financial outlook.

14. Citi Double Cash

The Citi Double Cash card presents a simple cash back system. It ensures you reap rewards not just for dining but for all your everyday purchases. This makes it an exceptionally versatile option for your spending habits.

What sets this card apart is its impressive dual cash back structure. You ll earn 1% cash back on every purchase you make, and then an additional 1% when you pay off those purchases effectively doubling the rewards you collect effortlessly.

Whether you re enjoying a meal at your favorite restaurant or stocking up on essentials, this approach simplifies the rewards process. It encourages you to maximize your everyday habits. If you love dining out or shopping for groceries, this card turns everyday spending into a rewarding experience, making every swipe feel both effortless and gratifying.

15. Delta SkyMiles Gold American Express

The Delta SkyMiles Gold American Express card is tailored for you, the frequent traveler who seeks to earn points on dining rewards while enjoying a suite of travel benefits designed to elevate your journeys.

This card combines dining rewards with travel perks seamlessly, allowing you to accrue miles from your everyday restaurant purchases. As your points accumulate, you can redeem them for flight upgrades, complimentary baggage, or even exclusive access to airport lounges, transforming your travel experience into something both enjoyable and cost-effective.

Whether you’re savoring a favorite dish or treating friends and family, every bite brings you closer to your next adventure. With this seamless integration of dining and travel, you can set your sights on new destinations, turning delightful moments into unforgettable escapades.

What Are the Benefits of Using a Rewards Card for Dining Out?

Using a rewards card for dining out brings a wealth of benefits your way. Enjoy cash back on your food expenses, enticing dining perks, and the chance to rack up points that can be redeemed for future culinary adventures or travel experiences, all tailored to your unique tastes.

By tapping into these rewards, you can unlock exclusive discounts at sought-after restaurants. Gain access to special events that truly elevate your dining experience. These cards often come with added bonuses like complimentary appetizers or desserts at select venues, providing that extra touch of value to your meals.

Many rewards programs enable you to earn points more quickly when you dine at partner restaurants. This amplifies the rewards you collect with every meal. Ultimately, embracing a rewards card not only enhances your immediate dining pleasure but also sets the stage for future adventures and culinary discoveries.

Key Factors to Choose the Best Dining Rewards Card

When choosing a rewards card tailored for dining, it s essential to consider several factors, including the card’s cash back rates, bonus categories, and how well it aligns with your dining expenses.

Understanding the cash back percentages can significantly impact the rewards you earn, particularly when dining out or ordering in. Look for bonus categories that encompass restaurants and grocery stores, as these can greatly enhance your returns in areas where you frequently spend.

By evaluating your consumer habits like how often you dine out or your monthly grocery bills you can pinpoint which rewards card truly delivers the best value. Aligning the card s benefits with your personal spending patterns ensures that the rewards meaningfully enhance your lifestyle, allowing you to maximize benefits while savoring every meal and grocery purchase.

How Can One Maximize Their Rewards on Dining Expenses?

Maximizing rewards on your dining expenses requires a smart way to use your rewards card for restaurant purchases. Engage with bonus categories and manage your monthly spending effectively to earn the most points possible.

Focus on your primary rewards card and explore additional special offers that can enhance your dining expenses. Pair your card usage with promotional deals from restaurants or loyalty programs to further boost your point accumulation.

By monitoring your monthly spending patterns, you can identify which dining expenses qualify for bonus rewards. This insight helps you prioritize and plan your meals wisely. Using these tips allows you to elevate your dining experiences while maximizing your financial return.

What Are the Potential Drawbacks of Using a Rewards Card for Dining?

Don’t overlook the potential drawbacks; they could affect your rewards journey. While rewards cards for dining come with enticing benefits, it’s crucial to consider the drawbacks that could diminish their overall value.

You might find the allure of earning points or cash back enticing, but it can lead to a slippery slope of overspending. You might start purchasing items you wouldn t typically buy, all in the name of maximizing those rewards. If you lose track of your spending habits, the interest fees and charges like late payment fees or foreign transaction fees can swiftly erase the benefits you initially aimed for.

Thus, it s essential to carefully weigh these risks against the potential rewards. This thoughtful approach empowers you to make informed financial decisions that align with your goals.

How Can One Determine If a Rewards Card for Dining Is Worth It for Them?

Determining whether a rewards card for dining is worth your time involves evaluating your dining habits, the card s annual fee, and how potential earnings align with your spending patterns and preferences.

Start by jotting down how often you dine out or order in each month, along with your average spend per meal. Next, calculate your total expenditure on food and drink to get a clearer picture of how many rewards points you can realistically earn.

It s crucial to compare these anticipated earnings against the card s annual fee to determine if the benefits truly outweigh the costs. Take a moment to consider the types of rewards offered and whether they resonate with your preferences, be it travel perks, cashback options, or something else entirely.

Adopting this systematic approach will help ensure that your chosen rewards card seamlessly complements your lifestyle while maximizing its value.

Frequently Asked Questions

What are the top rewards cards for dining out in 2024?

- Chase Sapphire Preferred

- American Express Gold Card

- Capital One Savor

- Citi Prestige

- Wells Fargo Propel

- Discover it Miles

What makes the Chase Sapphire Preferred a top rewards card for dining out?

The Chase Sapphire Preferred offers 2x points on dining, making it a great option for those who frequent restaurants. Plus, it also offers a generous sign-up bonus and flexible redemption options.

Why is the American Express Gold Card a popular choice for dining out?

The American Express Gold Card offers 4x points at restaurants worldwide, making it a top choice for foodies. It also comes with various travel benefits and a welcome bonus of 35,000 points.

What sets the Capital One Savor apart as a top rewards card for dining out?

The Capital One Savor offers an impressive 4% cash back on dining and entertainment, making it a popular choice for those who love trying new restaurants. It also has a $0 foreign transaction fee and a generous sign-up bonus.

Which unique benefits does the Citi Prestige offer for dining out?

The Citi Prestige offers 5x points on dining and air travel, making it a great option for those who dine out frequently and travel often. It also offers a complimentary fourth night stay at select hotels and various luxury travel perks.

Explore these options and find the rewards card that suits your dining habits!

Why is the Wells Fargo Propel a top rewards card for dining out in 2024?

The Wells Fargo Propel offers 3x points on dining. This makes it an excellent choice for earning rewards on everyday purchases.

It has no annual fee and a great introductory Annual Percentage Rate (APR) of 0% for the first 12 months. You can enjoy your meals while saving money!